The biggest complaint about social media is that it’s time-consuming. While I agree, there are tools to help speed up the process. With Social Media Management tools, we can spend a few minutes each day (or weekly) scheduling posts to go live while we’re busy with other things. Then all we have to do is check in here and there to engage with our audience. These apps help us to appear active on social media without absorbing large chunks of time.

My favorite social media management tool is Hootsuite. The free plan allows us to schedule up to 30 posts, which is plenty for a week. Once a post goes live, Hootsuite deducts it from our total. We can add three accounts (Twitter, Instagram, LinkedIn, Pinterest, etc.). Please note: As of September 11, 2020, Facebook no longer allows third party access. Figures, right? They’re the biggest time-suck of all.

We learn better with visuals, so let’s dig in.

Adding social media accounts is easy. In the Hootsuite dashboard go to Account. See my tiny photo in the bottom left corner? That’s where “Account” is located. Hootsuite will prompt you to add accounts. Once they’re added you can find them under “Private social accounts.” Ignore “Share Access” unless you have a VA or personal assistant to manage your social media.

The left column is our toolbar. Ignore the trophy for now. That’s where you can upgrade to the paid plan, but it’ll cost ya $29. monthly.

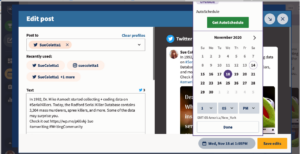

The icon below the trophy is where we create posts. I don’t use Hootsuite for Pinterest, but if you want to, this is also the place to create pins. When you click “Post” it’ll open this screen…

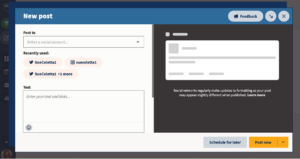

Some folks post to all their accounts at once, but I don’t recommend it. Each social media site has different requirements. For example, Twitter has a character limit and it’s best to only use 1-3 hashtags per post. Instagram has image restrictions and the more hashtags the better.

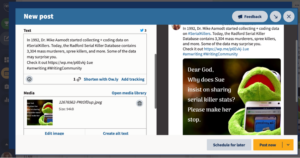

I’ll show you an easy way to repost the same article to different platforms later. For now, choose one account to “Post to.” Then drop down to “Text.” If you add your link first, Hootsuite will grab the image off the article. Or you can upload a new image. Another nice feature of Hootsuite is the built-in link shortener. Highlight the link and click “Shorten with Ow.ly.” Easy peasy.

I create my own images, but that’s a personal preference. If your article doesn’t have an image, don’t fret. Hootsuite comes with its own media library. Click the words: “Open media library” and the library will open in the preview window (where Kermie’s praying).

Now, suppose the image is too big. No problem. Click “Edit image” and tweak it until the image fits in the preview window. Once we’ve told Hootsuite which social media account we want to post to, it guides us.

To the left of “Edit image” is “Create alt text.” Alt text makes your content more accessible and improves the SEO. Describing your images also helps people with disabilities to engage with your content.

Next, we have the option of posting now or scheduling to post later. Rarely, if ever, do I immediately publish. My favorite thing about Hootsuite is its ability to publish posts while I’m writing.

When we click “Schedule for later” this window pops up…

As you can see, I scheduled this post for Wed., Nov. 18 at 1:05 p.m. Click “Done” then “Save edits” and you’re done.

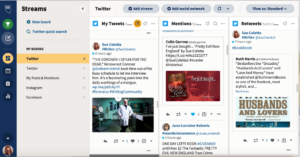

Let’s go back to the left sidebar. The icon below Create Post is Streams. Which looks like this…

We build boards however we want. I created a separate board for each social media account and then one complete board to show all my connected accounts on one screen. The above image shows only my Twitter board. I’m using it to show you another cool feature. The three columns to the right are called Streams, which we configure to suit our individual needs. There are several available options. I chose “My tweets,” “Mentions,” and “Retweets.” Play around with the configuration till it works for you.

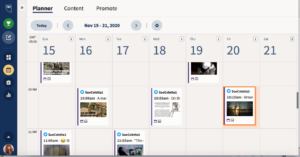

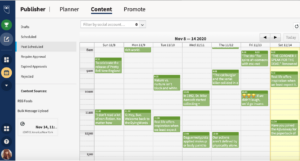

On the sidebar the next icon down is Publisher. Here’s what it’ll look like once you’ve scheduled your posts…

I like to stagger my publishing times so it doesn’t feel automated to my audience, but that’s another personal preference. You may want to schedule every day at noon. Hootsuite allows us to schedule posts at any time of the day or night. If you need to reach readers in a different time zone, then schedule posts to go live while you’re asleep. 🙂

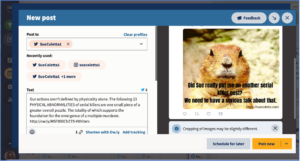

Okay, here’s the handy trick I hinted at earlier. Hootsuite allows us to duplicate posts to publish on a different platform. With the Publisher open, click any post you published or scheduled, and the following screen opens.

By clicking the three dots in the upper righthand corner next to “More options” the “Duplicate” box pops up. By clicking “Duplicate” it opens the post as it appeared when we published or scheduled it. Only now, it’s in a New Post format.

In “Post to” swap one social media account for another. As I mentioned earlier, you may need to tweak the image and add/subtract hashtags, but that’s it. Either “Post now” or “Schedule for later.” Or we can leave the post as is and just schedule it to go live again on a different time/day. Duplicating posts saves us from having to create 30 new posts per week, if we’re only scheduling on a weekly basis.

With the free plan, we also have the option to schedule a new post as soon as a previous one publishes. As long as we don’t climb higher than 30 posts scheduled at one time, we’re good. An upgrade comes with more bells and whistles but $30 for this and $30 for that adds up after a while.

Once we schedule the duplicate post, Hootsuite brings us back to the Publisher. At the top click “Content” and all our published posts show on the screen.

We can filter by social media account or view Drafts, Scheduled, or Past Scheduled posts.

Hootsuite offers numerous ways to save us time. I’ve only scratched the surface, but I’m trying not to overwhelm you. These steps may seem like a lot of work. They’re not. Once you get used to creating posts, you’ll zip right through the process. Remember the 80/20 rule, 80% valuable content, 20% book marketing (90/10 is even better). If you struggle with the 80% part, post a quote from the book you’re reading (include title/author). Or share a blog post or pet photo. The point is to keep your audience engaged.

I’ve only concentrated on one social media management tool, but there are others. Some free, some paid. If you’re still hopping from one social media site to another, you’re wasting valuable writing/research/reading time.

If you haven’t tried a social media management tool yet, I hope this peek into Hootsuite demonstrates its time-saving benefits. Do you use social media management tools? If so, what’s your favorite? Any tips to share?

Poe was NOT pleased about Rave’s decision.

Poe was NOT pleased about Rave’s decision.

When I bustled down the hill to Animal Planet the following day, one flawless raven feather laid on the rock

When I bustled down the hill to Animal Planet the following day, one flawless raven feather laid on the rock

Picture this. You’re

Picture this. You’re