by Debbie Burke

Photo credit: Jake Blucker – Unsplash

When Alvin Schottenstein died in 1984, employees of Schottenstein Department Stores wept, describing their boss as kind and compassionate. Alvin and his brothers had built the Columbus, OH retail business, started by his father in 1917, into a multi-billion-dollar conglomerate.

Alvin was well known as a dedicated family man who said: “The time I get to spend with my grandchildren is the greatest time of my life.” (7/8/84 Columbus Dispatch article)

Almost four decades later, Alvin’s widow Beverley, now 94, sued two of those grandsons, Evan and Avi Schottenstein, along with J.P. Morgan Securities, in an elder fraud case. Her claims included financial fraud, abuse of fiduciary duty, and fraudulent misrepresentations and omissions.

Beverley is the matriarch of the Scottenstein empire whose holdings include American Eagle Outfitters, American Signature Furniture, DSW, and others. In 2015, the Schottenstein family was named #100 of the richest families in America by Forbes.

But…money does not guarantee happiness.

In 2014, Beverley’s grandsons Evan and Avi were employed by J.P. Morgan as brokers. During their five-year tenure handling her account, they made hundreds of stock trades, reportedly earning millions in commissions. But, despite Beverley’s many requests for information, they refused to tell her details of the transactions, stating only that they were doing well for her.

According to Bloomberg News, while the grandsons were supposedly growing her investments, Evan would challenge Beverley over charges she made with her own credit cards, which he evidently monitored. He criticized her for patronizing a non-Kosher restaurant and scolded her for watching TV on Shabbat.

Beverley’s son (Evan and Ari’s father) lives a few floors below Beverley in the same condominium building in Bal Harbour, FL, putting the grandsons in convenient proximity to her.

Evan reportedly entered Beverley’s home unannounced and shredded documents relating to J.P. Morgan. Charges appeared on her credit card statements that Beverley had not made. Her seven-million-dollar diamond engagement ring disappeared from a safe deposit box to which one grandson had a key. A check to her caregiver bounced because the bank had frozen her account.

What happened to the money her grandsons were handling for her?

After several years of suspicions and unanswered questions, Beverley insisted they had to consult her before making trades on her account. Her banking, credit card, and stock statements from J.P. Morgan mysteriously stopped being mailed to her.

Despite a phone conversation with J.P. Morgan Chase CEO Jamie Dimon, Beverley’s requests for reports and proper accounting were ignored.

In 2019, she’d had enough and consulted a lawyer. After an audit of her finances, an accountant concluded: “It appears that Ms. Schottenstein’s broker sold her these risky, illiquid products without regard for her financial wellbeing to generate extraordinary income for him and for his employer.”

The unauthorized buying and selling of securities amounted to more than $400 million.

Assisted by her granddaughter Cathy Schottenstein (cousin to Evan and Avi), Beverley sought help from FINRA (Financial Industry Regulatory Authority) because “retail investors can’t take their brokers to court.” (Source: NextAvenue.org)

Shortly before the case was filed in 2019, J.P. Morgan terminated Evan and Avi. According to the FINRA letter of acceptance, waiver, and consent, Evan Schottenstein was “[d]ischarged” and provided a termination explanation stating, “[c]oncerns relating to trading activity for the account of a family member, and the accuracy of the records regarding the same.”

After arbitration, in February 2021, FINRA found J.P. Morgan and Evan liable for elder abuse according to Florida statutes.

FINRA awarded Beverley $19 million, ordering “J.P. Morgan to pay $8.9 million, Evan Schottenstein to pay $9 million as the chief beneficiary of the scheme, and Avi Schottenstein to pay $620,000. They were also ordered to pay legal fees and Finra hearing costs.” (Source: fa-mag.com)

Beverley’s granddaughter Cathy Schottenstein has written a soon-to-be-published memoir entitled Twisted, chronicling her grandmother’s ordeal.

This determined nonagenarian didn’t allow herself to be victimized by her own flesh and blood and refused to give up against one of America’s largest banks.

Beverley followed the money. Unfortunately it led to the discovery of family betrayal that would have devastated Alvin Schottenstein, Evan’s and Avi’s doting grandfather.

~~~

Thanks to Ann Minnett for alerting me to this case.

~~~

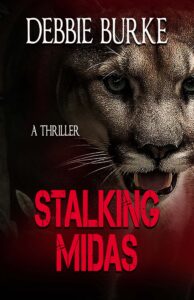

A glamorous predator zeros in on an aging millionaire until investigator Tawny Lindholm interferes. Then elder fraud turns deadly in Debbie Burke’s thriller, Stalking Midas.

Buy links: Amazon Major online booksellers

Debbie, you should be especially proud of this morning’s post. You provided more information about this case in a few paragraphs than the Columbus Dispatch, a once magnificent newspaper which now, under the ownership of GateHouse Media/Gannett, isn’t fit for use as outhouse tissue. There has been one article about this case published in the Columbus Disgrac…er, Dispatch, and that was in February 2021.

Schottenstein’s had several stores in the Columbus area but was known nationwide as Value City. A multipurpose venue on the campus of The Ohio State University is known as the “Jerome Schottenstein Center/Value City Arena.”

Thanks as always for a terrific post.

Hi Joe,

I figured you would be familiar with this case. The family was behind many landmarks in the Columbus area.

Even though Beverley won her case, it makes a sad last chapter for her life.

Thanks, Debbie, for a great post. Good for Beverly Schottenstein for taking back control and fighting to regain what was hers. I don’t keep up on Columbus news, but I spent seven years in Columbus many moons ago in medical school and residency. I remember shopping in the downtown Columbus Schottenstein store. And the Schottenstein Arena sits on what was then my jogging field.

Your post has sparked my interest in Stalking Midas.

Have a great day!

Thanks, Steve.

She’s a gutsy, determined lady, all right.

Several years ago, when my adopted mother was a victim of elder fraud, a certain bank did zip-squat to block bogus charges on her credit card. However, they did require 10 business days for their legal department to review my sister’s power of attorney to make sure she had proper authority to freeze our mother’s account.

So I esp. admire Beverley for standing up.

Bravo for Beverly Schottenstein. So many elders are the victims of fraud that it’s satisfying to see a lady in her nineties insist on justice — and get it.

It must be a bittersweet victory for her, though, knowing her own grandsons were bilking her. The love of money does seem to make people do all kinds of ugly things.

Agreed, Kay. Don’t mess with Granny–she’s formidable.

Wow! What a case…it’s amazing to me that there are people out there who think nothing of stealing from their own families. Very sad.

The folks who helped them get away with bilking their own grandmother deserve the same, or worse, than the boys.

“The love of money is the root of all kinds of evil…” I Timothy 6:10

Deb, the greed of relatives is hard to understand but unfortunately all too common. There appears to be plenty of family money to go around yet evidently it wasn’t enough for some people.

Ripping off friends and family has a long history. Trust “Dave” who you saw at a display table at the mall with your retirement account? Probably not. Trust “Bernard” who sits in the next pew over at church every Sunday?

Sadly very true.

Debbie, you did fine work detailing this story in today’s post. I wish I could say I’m shocked that her grandsons took advantage of her in this way, but such cases do happen, just not at the financial scale of this one.

It’s telling that Beverly Schottenstein reaching out to Jamie Diamond at Morgan Chase didn’t result in the paperwork being released. I would have thought that money would have talked in that case, but perhaps the two grandsons were able to persuade the higher ups at the company that they were acting in their grandmother’s best interests.

I’m glad to see that justice was done, in the end, but how sad for her and her grand daughter that they had to go through this.

Thanks, Dale.

Yes, shocking that a CEO wouldn’t dig a little deeper when something stinky was obviously going on.

Commission churning on stock trades brings in lots of $$.

Wowza! Great story so well told. Thanks, Debbie.

The Schottenstein story reeks, and like Dale Ivan Smith, I have to wonder why a call to Jamie Dimon didn’t result in quick action. Oh, well, on second thought, maybe no reason to spend much time.

Catch this exchange between Jamie & Eliz Warren in late May at a Senate Banking Committee hearing:

“You’re the star of the overdraft show,” Warren told Dimon. “Your bank, JPMorgan, collects more than seven times as much money in overdraft fees per account than your competitors.”

Dimon shot back. “At any request when someone said they needed COVID relief, they got $120 million of COVID relief on request,” he claimed.

“You and your colleagues come in today to talk about how you stepped up and took care of customers during the pandemic and it’s a bunch of baloney,” said Warren.

Banks always look out for their customers’ best interests, Ruth. And if you believe that, I can offer you this really good deal on a bridge for sale.

Thanks, Debbie, but I already own a bridge. It’s called the Brooklyn Bridge. 😉

Some people are such sh*ts. It would be interesting to see how much of an inheritance those two grandchildren lost from their grandmother and, if there’s justice, their parents. But right-now greed always trumps a-bit-later greed.

“right-now greed always trumps a-bit-later greed.”

Marilynn, what a great insight into human nature.

Great story, Debbie. Anyone who steals from family are the lowest of the low. (Sorry, I’m late. Offline all day yesterday).

Thanks, Sue. It’s never too late to stop by TKZ.

Debbie, I finally caught up with my reading. Thanks for the mention.

I monitor the finances of my 94 yr-old mother, pay her bills, and make sure no one takes advantage of her. Thank heavens my siblings and I are on the same page. I can’t imagine taking advantage of a ‘loved one’ to this extent.

Hooray for Beverley!

Thanks for passing the story my way, Ann. Your mom is truly blessed to have you looking out for her.